Are you spending wayyyy to much money and not sure where it is going?

That’s the situation I found myself in this last month.

I have a monthly plan to review my credit card statements, but after the end of last month I had the question: “Where did it all go?”

What Doesn’t Work (for me)

I’ve looked at things like mint.com to track expenses, but so far I haven’t found anything I like. mint.com does a horrible job of classifying expenses (side note: I have high hopes for UGHMoney). How should I know what to cut and what to keep?

How I’ve Cut Expenses in the Past

My method in the past was pretty simple:

- Review my bank and credit card statements

- Identify recurring expenses

- Cut these recurring ones out

I decided up front to save money, but not be a cheap skate. I only wanted to cut out those things that added marginal value for me. Some things (like spotify) I plan to keep as a) they don’t cost much and b) they provide plenty of enjoyment. For others, I decided to substitute cheaper alternatives. Ting, for example, was a much cheaper carrier than verizon.

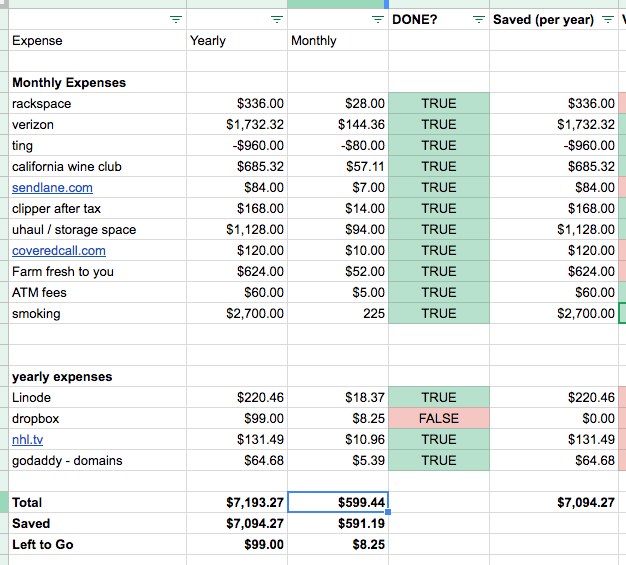

A bunch of these took several months to phase out. I decided to keep a spreadsheet of these expenses:

Some of these things were providing zero value to me. Others (like smoking) were actually hurting me. And others I enjoyed, but just weren’t worth the money.

Overall, I’m saving $600 per month – over $7k per year! And that’s just from recurring expenses that I don’t care that much about.

How I Continue to Cut Expenses Each Month

After reviewing my credit card statements a few times, I realized the easiest way is (gasp) paper!

I’ve switched back to paper billing for my credit card statements. I get the statements once a month and circle any charges that I’m unsure about (or anything I want to cut out). It only takes a few minutes and keeps me conscious of what I’m spending.

My New Method of Cutting Expenses

But as mentioned before, I had cut out all of those pesky recurring items without having a good sense of where is my money was going. My biggest issue was that I had a ton of little expenses.

Yes – I could classify them. It turned out a large percentage were going to food (eating out / drinking out) and personal development books and courses.

I wanted a way to set some limits on each of these categories and “bucket” them (or confine/categorize them) to a certain dollar amount each month or each week.

After some googling, I discovered “Envelope Budgeting.”

Envelope Budgeting is basically this: when you receive your paycheck, you create a series of envelopes. You put a fixed amount of money into each envelope at the start of every month. (For instance: $1000 into the rent envelope, $500 into the food envelope, etc). Any time you spend money, you just take it out of the corresponding envelope.

Using Cash? No way!

This technique of bucketing your money and only spending what you’ve allocated through cash envelopes is of course really old school.

I don’t carry around cash ever. I pay for everything with credit cards. (I don’t have debt on credit cards. I actually use them as cash back debit cards).

Luckily, there’s an answer for millennials: an app!

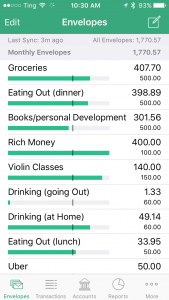

I’m currently using “GoodBudget” on the iPhone.

How it works: basically, you create a series of “envelopes” (buckets or categories) and allocate money to each of them. Every time you make a purchase, you manually set the category, who you paid, and the amount.

Turns out that manually entering this stuff makes you very conscious of what you are spending.

Here’s a screenshot from my actual budget:

When that green bar goes down to empty, I’m out of money in the envelope.

And that little black horizontal bar shows where I should be to be on pace.

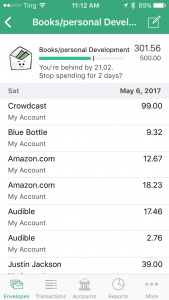

If I go over, I can visually see that. And I can tell how long I should cut out spending in that category:

I already know this is going to help tremendously.

What’s your best budgeting tip? What are you doing to reduce expenses?

4 replies on “How I’m reducing my budget by $1k this month.”

You are right, Mint is HORRIBLE for how it classifies expenses. You’d think after 10 years they’d have someone smart enough to write code to figure it out. Just some items. What Mint considers “Merchant”:

–Best Buy Visa is labeled as “Deerfield, IL”

Merrick payment is labeled as “Mobile Thank You”.

Merrick payment the previous month .. “Online One Time”

Barclaycard payment labeled as “Received”

Walmart payment labeled as “Thank You”

Kohl’s purchase is labeled as “E Commerce”

Kohl’s purchase again… “Rocky Point Store”

Kohl’s payment is labeled as “Thank You For”

I had another payment from my bank to wherever and Mint labeled the merchant as “Inst Xfer”.

The worse part? You have to change merchant labels EVERY SINGLE MONTH. EVERY. SINGLE. MONTH. ALL. YEAR… ROUND…

I used mint about 6-7 years ago and figured I’d try it again and NOTHING has changed.

I’ll now delete my account for good and never use it again. One of the largest financial companies in the US and this is pathetic.

Thanks for your personal marvelous posting! I definitely enjoyed reading it, you happen to be a great author.I will make sure to bookmark your blog and will come back down the road. I want to encourage you to ultimately continue your great posts, have a nice evening!|

Thanks. You can also subscribe to the email list to get email updates.

Thanks for sharing informative post. Keep Posting.