I’ve been looking for alternatives to traditional stock/bond mixes. Why?

Although “everyone knows” that “stocks go up in the long run”, that doesn’t mean most people can stomach the volatility. Can you really imagine seeing half of your money disappear overnight?

Also – although stocks have historically always done well over a 15 year time period, 15 years is a long time for a young guy like myself. My life will probably be radically different in 5-10 years!

So the traditional alternative is to temper the portfolio with bonds. But in this low interest rate environment, that causes a lot of drag on the portfolio and means that you get almost nothing in return. So I’ve been looking for alternatives.

One alternative that looks interesting is presented in “Money: Master the Game” by Tony Robbins where he interviews Ray Dalio.

Dalio gives a basic formula for an “All Weather” fund – one which doesn’t have the same volatility as a traditional stock / bond mix. Here’s the formula:

- 30% Stock

- 15% 10 Year US Treasuries

- 40% 30 Year US Bonds

- 7.5% Gold

- 7.5% Other Commodities

The idea behind this portfolio mix is that with a traditional stock/bond portfolio usually when the world becomes a scary place, everyone just goes to cash (or to short term T-Bills) and it becomes a “risk-off” environment. This is exactly what happened during 2008. Dalio makes the point that the world is “long everything”

And what a weird portfolio. Over 50% bonds and only 30% stock. Must not return anything, right?

Curious, I decided to pull data from various ETFs and compare what would have happened over time with different mixes and contrast it to the All-Weather Fund.

- 100% Stocks

- 90% Stocks / 10% Bonds

- 80% Stocks / 20% Bonds

- 70% Stocks / 30% Bonds

- 60% Stocks / 40% Bonds

- 50% Stocks / 50% Bonds

- All Weather Fund

For the Stock / Bond Mix, I used VTI and BND.

For the All Weather Fund, I used VTI, IEF + TLT for treasuries, GLD for gold, and DBC for a mix of commodities.

Back test went from Apr 2007 – May 2019. I used these dates because they were the max amount of data I could find (not all of these ETFs existed before these dates).

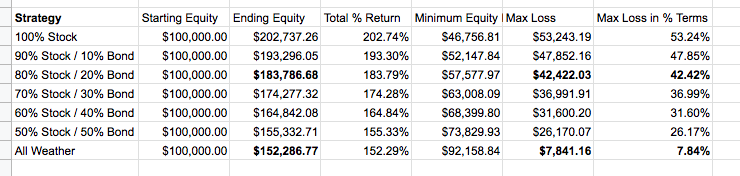

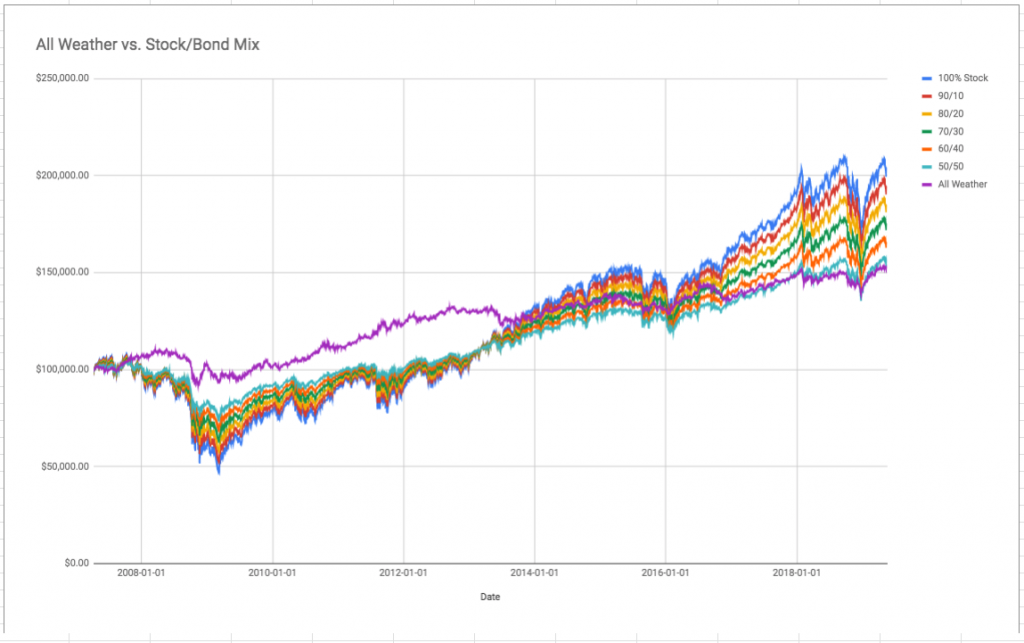

Here are the results:

That purple line is the All Weather fund. The other ones are stock/bond mixes. As you can see, the long term winner was the 100% stock mix (no surprise there). But the All Weather fund during the 2008 crash only had a max drawdown of 8%. On the other hand, you can see that if you had invested $100k right before 2008 you might be one year later sitting on only $60k. How scary is that!? For me, I know I would “puke” as the futures traders say.

Here’s a link to the data sheet:

https://docs.google.com/spreadsheets/d/1j7Hm45ONXAOGU_-MA30dZhV4lWbOyVNjWDJDrPhxjaQ/edit?usp=sharing

I think the FI/RE movement has a lot of great things going for it, but one thing that is often underemphasized is that money is largely about self-knowledge, and that requires you to ask (and answer) questions such as:

- Why does money causes such extreme emotions?

- How do you handle drawdowns (both on a practical and emotional level)?

- Have you spent enough time really planning out what you will do if things don’t go “to plan”?

- Can you handle (and will you stay in the market) when your account has lost half its value?

I think many in the FI/RE movement can’t stomach these drawdowns and unconsciously move to Real Estate as an alternative to dampen the volatility (buy and hold RE seems to have more steady returns through cash flow).

Instead of getting tied up in a non-liquid asset that has high transaction costs (RE), why isn’t portfolio construction talked about more?